A huge part of reputation management focuses on your business reputation amongst your customers. Current and former customers who leave negative reviews can tank your reputation and make it more difficult to get new customers. Since customers drive profits, there’s a strong financial incentive to optimize and bolster your reputation. However, this only looks at the subject from one angle. Others must be considered.

For example, a new startup might be seeking venture funding. If the individuals involved in the startup have a poor past reputation, or if the initial actions of the startup were faltering and unclear, it’s possible that investors will see a poor reputation and will stay away. Thus, reputation management is a requirement for investor relations.

The same can be true of larger, more established companies. Any time a business seeks investments, whether it’s to fund a startup, start a new offshoot business, launch a new R&D campaign, or just to keep operations going, the reputation involved must be as pristine as it can be. Every hint of a poor reputation is a worse deal, a worse investment, or a lost investor.

Unfortunately, investors are rarely public with their thought processes and don’t always consciously think about factors such as reputation and how it impacts their decision-making. This means that the effects of reputation on investments are poorly studied.

“The reputation of an organization is one of the most effective and least measured determinants in investor relations. This is because little is known about how reputation determines investors’ conscious decision-making and even less is known about the unconscious effects of reputation. Today signs indicate that many investors are becoming more reputation-conscious than before. This implies that they begin to think beyond only short-term returns and that they are becoming aware of the long-term consequences of reputation management.” – Reputation Affairs

How can reputation impact investor relations, and what can you do to improve it?

The Purpose of Investor Relations

First, let’s talk about the overall purpose of investor relations. After all, a company can’t simply exist passively and hope that investors come to find it. Investors need to be actively approached and courted. When so much is on the line – potentially millions of dollars, and/or the entire success of a business venture – managing investor relations is crucial.

Whenever there’s a role that must be filled, there’s a job opening to fill it. Thus, the industry of investor relations is a career path for many, who specialize in all aspects of the relationship between business and investor. Whether you’re hiring someone for Investor Relations specifically, or you’re contracting a firm or contractor to do it, chances are you will have an individual or a team specifically handling investor relations for you.

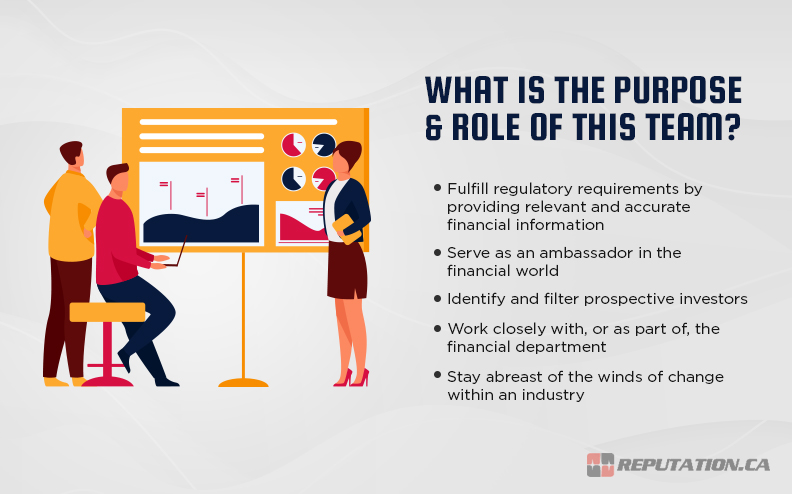

What is the purpose and role of this team? They do more than simply interface between you and prospective investors. They:

- Fulfill regulatory requirements by providing relevant and accurate financial information, while also protecting the company by conveying the minimum necessary information.

- Serve as an ambassador in the financial world, advertising the company to prospective investors and getting them to express interest, to initiate a potential relationship.

- Identify and filter prospective investors, to remove those who don’t have experience in the industry, who don’t operate on the same level of capital, or who would inevitably decide not to fund the company, thus wasting time.

- Work closely with, or as part of, the financial department, to set and manage expectations and help predict the future finances of the company.

- Stay abreast of the winds of change within an industry, and monitor the situation for a potential sea change in investor opinions, in interest in the company, or in alternative funding models that could be used in addition to or in place of traditional investor funding.

The positions and roles of an investor relations officer in modern business are changing rapidly. Modern internet-based funding opportunities, ranging from newcomer angel investors to crowdfunding, must be explored. Per the Harvard Business Review:

“In a new world of activist investors are increasingly willing to weigh in on company strategy, today’s IRO must be a more proactive leader, building constructive relationships throughout the shareholder base to help the company mitigate various risks.”

All of this, in some way, is influenced by the overall reputation of the company and its executives.

How Reputation Impacts Investor Relations

Reputation has a major impact on investor relations, and it can be good or bad.

A company with no reputation is either new or not noteworthy. A new company can develop a reputation, but a company that has existed for years with no reputation is a company with nothing going for it. This is not attractive to an investor; what evidence do they have of the potential success of the company, given funding? They’ve had plenty of opportunities to build a reputation, and have failed. A company without a reputation is a company that is likely not trustworthy.

Often, the more reputable a company is, the more trustworthy it is. This isn’t always the case – some companies have large and impressive reputations, but have a major history of shady operations on the side. Take, for example, megacorps like Nestle, Nike, or Apple, which present a positive public face, but which hide negative operations such as near-slave labor in third world countries as a foundation of their businesses. Or consider Hobby Lobby, presenting itself as a Christian organization, but dealing with stolen artifacts and antiquities smuggling in the shadows.

Public reputation also impacts how viable an investment may be. An investor wants to see the company they invest in to succeed, so they can recoup their investment and profit from the transaction. If a company has a poor reputation, it will likely either fail to launch, stumble as it grows, or suffer public outrage and backlash, depending on the reason for its reputation. Again, per Reputation Affairs:

“Investors understand that financial parameters are important but the reputational reality is more vital since a company that doesn’t have a reputation to protect is a company that doesn’t have anything to lose and a company that doesn’t have anything to lose is a company that is not reliable.”

This makes reputation a core component and, in many ways, a force multiplier for potential investments. An investor might be willing to invest more in a company with a good reputation, while a poor reputation will make them hesitate or even drive them away.

Improving Investor Relations Via Reputation Management

Reputation management must concern itself not just with the opinions of everyday customers and potential customers, but with those of top-level investors. Investors often have access to streams of information not usually available to the average customer, as well as being able to see any-and-all sources of reputation that a customer can see.

This makes courting investors all the more difficult. A business can’t simply sculpt their reputation with the BBB, with Yelp, and with Google, and call it a day. They must consider their mentions in publications, including those that are straight reporting on financial statements rather than editorialized coverage.

As a company, when you’re looking to improve your reputation via reputation management, there are many different aspects you should consider and focus on improving.

Sharpen and optimize your corporate story. If you want to sculpt a reputation that is effective at attracting investors, you must be able to refine and portray your corporate story in short order. Investors don’t have the time or the desire to filter through templated reports, packets of news coverage and press releases, or a long and winding video about the history and foundation of the brand. No, a corporate story must be optimized and targeted to investors specifically.

Most companies will maintain more than one version of their overall story. The core story is the same, but which elements are emphasized depends on the target audience. The story given to customers is different from the story given to prospective employees, which is different than the story given to investors. Even different groups of investors may be interested in different aspects of your overall story. Part of investor relations is doing the legwork to identify, profile, and target individual investors or investment firms with a laser-focused version of the corporate story.

Maintain awareness of your ongoing reputation. A key part of reputation management is building and maintaining an awareness of your reputation as a whole, both as it stands and as it develops. The best way to do this is to hire a reputation management firm to analyze and report on your current reputation and invest in reputation tracking software to keep an eye on it once any current issues have been dealt with.

Monitor and address reputational issues as they develop. There exists the potential for a reputational issue to flare up at any time. Currently, these are typically related to a few primary topics. Topics include:

- The quality of product or service.

- The speed and accuracy of order fulfillment.

- The quality, attitude, and responsiveness of customer service.

- The reliability and viability of financial reports and statements.

- The past treatment, relationships, and recovery of previous investments.

- Any legal issues or ongoing court cases you’re involved in.

- The statements and opinions, political or otherwise, of your leadership.

Keeping on top of any potential developing reputational issues allows your company to address them before they become major problems, and to downplay major problems into minor problems. Only the most extreme of issues – such as what is currently unfolding with Activision-Blizzard – become major problems for customer and investor relations.

Work to reduce the impact of past poor reputation. The core of any good reputation management is the mitigation of existing and past reputational issues. This means, among other things, addressing customer complaints, getting false or fake reviews removed, and investigating any company or systemic problems that lead to reputation issues.

Work to improve current reputational coverage. The other core component of reputation management is bolstering positive coverage. Negative coverage can only be suppressed so much, and it can never be fully removed. Thus, pushing a positive narrative helps outweigh the negative. Every company will have disgruntled customers, failures and unexpected challenges in supply lines, or the occasional bad apple in the employment roster. Pushing a positive story, particularly when it’s related to addressing those issues at a systemic level, can help dramatically.

Don’t forget the individual reputations of managers, executives, and C-levels. A company’s reputation is not just about the company. If it comes to light that a CFO, CEO, CIO, or other C-level has a troubled past, this can shake confidence and reduce your company’s reputation even if that individual has not shown any of the same behaviors in their current role as they did in the past. Remember, a company is the sum of its parts, not just what it portrays itself to be, and investors will consider many factors beyond just the reputation of the company.

Develop a financial reputation report to put front and center. Of core concern to investors are the financial stability, viability, and sustainability of the company. Thus, developing a clear, concise, and comprehensive financial report to deliver to investors is key. They want to know if you’re a good investment, and they’ll have specific questions. Developing a solid and persuasive picture of your finances is a good way to help sway them.

Be ready to acknowledge past issues and describe steps taken to avoid repeats. Companies often need to attract investors during a time when they are struggling and need the money to pull themselves up into financial solvency.

If you need dedicated, business-level reputation management, your best bet is to talk to a firm like ours that specializes in exactly that. The relationship you build with investors is heavily reliant on your reputation, so refurbishing any reputational issues before approaching investors puts you in a much better position to secure the investment you deserve. Feel free to reach out at any time if you have any comments, questions, or concerns.